India’s top two private service providers, Bharti Airtel and Reliance Jio, recently announced their financial results for the third quarter of the current financial year.

The quarter was significant because India conducted its 5G spectrum auction last year, and both Airtel and Jio launched 5G services in October 2022. Both telcos are in the midst of expanding 5G coverage. However, neither of the two telcos has revealed the number of 5G subscribers.

The launch of the 5G services is one of the key reasons Airtel’s capital expenditure recorded a massive jump from INR 56,970 million ($690.33 million) in the September 2022 quarter to INR 81,058 million ($982.2 million) in the December quarter. On the other hand, Jio didn’t reveal quarter CAPEX in the results.

Profit and loss

Airtel India recorded revenue of INR 249.62 billion ($3.02 billion) in the quarter ending December 2022, up by 19.4% year-on-year, while its mobile business grew by 20.8% year-on-year to touch INR 193.52 billion ($2.342 billion). This is because of improved 4G subscriber additions in the quarter. As a result, it reported a profit of INR 15.88 billion ($192.24 million) in the December quarter, up from INR 8.29 billion ($100.33 million) in the same period a year ago.

On the other hand, Jio has reported a profit of INR 46.38 billion ($561 million), growing by 28.2% compared to INR 36150 mn ($437 million) profit in the same period the previous year. Reliance Jio recorded a revenue of INR 229.98 billion ($2.78 billion) in the December 2022 quarter up from INR 193.47 billion ($2.34 billion). The growth is because of the rising number of subscribers as well as data consumption per consumer.

While Vodafone Idea is yet to announce results, it will likely record losses since it continues to struggle financially. However, the government of India has recently taken a 33.4% equity in the company in lieu of the interests, which is likely to help the company stabilize.

Key performance indicators: ARPU, data usage and more

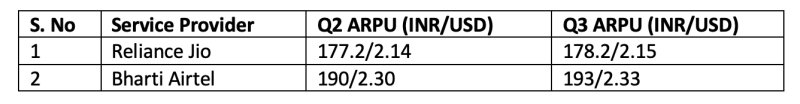

Airtel’s ARPU increased by 1.5%, up from INR 190 ($2.3) in the September quarter to INR 193 ($2.33) in the December quarter. Jio recorded a marginal increase in its ARPU from INR 177.2 ($2.14) to INR 178.2 ($2.15).

The quarter saw Airtel increasing the minimum rates for prepaid subscribers in two service areas from INR 99 ($1.19) to INR 155 ($1.87). This was later extended to seven states.

On the subscribers front, Jio added 5.3 million new subscribers in Q3, taking its customer base to 432.9 million. This is significant since it was losing customers in the previous three quarters. Reliance Jio’s data traffic increased by 23.9% YoY to 29 billion GB, while voice traffic soared by 10.4% YoY to 1.27 trillion minutes in Q3FY23.

Airtel recorded a slight increase in its subscriber base, up from 327 million in the September quarter to 332 million in the December quarter. It added 6.4 million 4G subscribers in the December quarter, taking the number to 216 million. However, the average monthly data usage per customer remained flat at 20.3 Gb.