AT&T and Verizon have both raised prices on some of their wireless plans recently, citing inflation as the culprit. T-Mobile has not made any similar announcement because it has a commitment not to raise prices for three years from its April 2020 merger with Sprint. Industry analysts have spent quite a bit of time analyzing the effect that price increases might have on revenues and churn. This week, the analysts at LightShed Partners also looked at the benefits wireless operators might incur from cost cutting.

Analysts Walter Piecyk and Joe Galone note that the ongoing investments in 5G are not paying off with notably higher revenue growth. And the general economic outlook should be causing wireless operators to plan for a recession. They looked at five areas where carriers could save money:

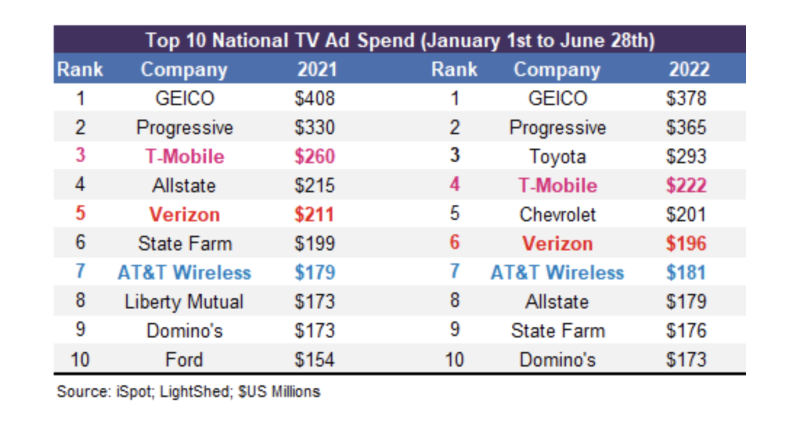

Advertising

Using data from iSpot, the analysts noted that T-Mobile, Verizon and AT&T have all spent over $180 million in advertising in the first half of 2022.

"We believe this expense can be turned off and on with relative speed," wrote LightShed. "We were disappointed by the lack of growth impact that Verizon achieved from the marketing blitz that followed its 5G launch on C-Band spectrum."

Stop paying for streaming services

Earlier this month AT&T dropped HBO Max as an incentive for its highest tier.

Verizon and T-Mobile are still offering free streaming services as a key perk for customers on their premium unlimited data plans. Verizon offers free Disney+, Hulu and ESPN+ plus 50 GB of hotspot data with its Get More Unlimited Data plan that costs $90 per month and T-Mobile bundles in a free Netflix subscription plus 40 GB of hotspot data to its Magenta MAX that costs $85 per month.

LightShed said Verizon and T-Mobile could consider dropping or renegotiating the partner pricing on their new customer promotions for free Disney+ or NetflixonUS, respectively. “Neither of these offers appear to be moving the needle on market share,” said the analysts.

Slow/cut the capex

The wireless carriers are all spending big on capex in 2022. AT&T and Verizon will each spend more than $20 billion, and T-Mobile projects it will spend over $13 billion in capex for the year.

But LightShed said, “There appears to be little perceived network differentiation across the wireless networks in the United States despite the deep spectrum deployed in recent quarters. Winning speed tests are nice on Opensignal or PC Mag, but where’s the resulting improvement in share of gross additions?”

They said investors should be questioning the capex pace in relation to revenue growth.

Headcount reductions

Last, but not least, carriers can always cut headcount to save money. LightShed said the early work spent launching new projects like mmWave, C-Band integration, small cell layer cakes, Massive MIMO antennas and shutting down legacy networks is winding down. It might be time to consolidate and reorganize functions.