Riot Micro is making its market debut with a twist, employing Bluetooth and Wi-Fi engineers, along with LTE, to create a more affordable and lower power chip for cellular IoT networks.

“It was a bit of a departure in terms of the way traditional LTE modems get put together,” said Peter Wong, CEO of Riot Micro. “Our premise was: We want to get the cost and power of these LTE chips down to the same level as Bluetooth and Wi-Fi. That’s where we think the price points need to be to really deploy in volume.”

LTE traditionally has been more complicated and sophisticated, but Riot Micro put together a team that includes people who worked on the LTE protocol stack at BlackBerry, as well as talent from Newport Media (acquired by Atmel), Broadcom and Qualcomm. Wong himself is a former systems engineer at PMC-Sierra.

The way Wong described it, the team was able to leverage and borrow a lot of design techniques from the Bluetooth and Wi-Fi worlds and apply it to cellular in such a way that it strips out extraneous things but provides the essentials that meet 3GPP Release 13 requirements for NB-IoT and Cat-M1 eMTC.

RELATED: Senet: LoRa offers advantages over cellular’s NB-IoT solutions

Unlicensed IoT technologies often are framed as more affordable than cellular-based IoT. LoRaWAN proponents, for example, have pointed out LoRa’s advantages in the areas of cost and power over cellular-based solutions. Generally speaking, Senet has said it figures about three times less power is being consumed by a LoRa application than by a NB-IoT application.

Riot Micro set out about two and half years ago to change that paradigm.

“We really took it to the bare minimum in terms of what was required,” Wong told FierceWirelessTech. “It only supports NB IoT and Cat M1,” but it looks like something out of the Bluetooth or Wi-Fi world.

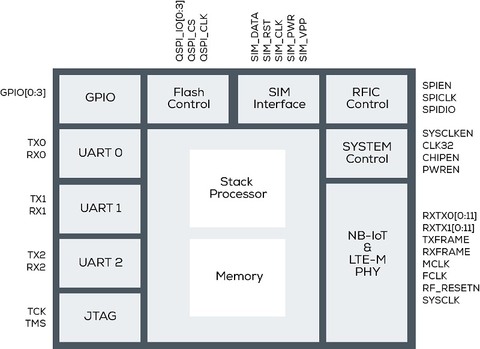

Riot describes RM1000 as a hardware-centric baseband controller, tightly coupled to an optimized LTE protocol stack running on an ultra-power efficient integrated processor. The PHY layer, implemented completely in hardware, enables minimal eDRX cycle power consumption and extremely fast wake/sleep transition times. Such power savings mean that IoT modules based on the RM1000 can run longer on lower capacity batteries, further saving on costs.

The company isn’t revealing the exact cost of the chip. "The industry is pushing module prices towards a target of $5 in volume, and Riot's technology will certainly support this goal," Wong said.

Riot Micro is making the RM1000 available for OEMs and module manufacturers that are developing custom solutions and offers a range of customer support services, including reference designs for evaluation and module design. Potential uses include asset management, home automation, industrial, point-of-sale, smart energy, vending and automotive applications.

Competitors include the likes of Altair, which was acquired by Sony, and Sequans Communications. Based in Vancouver, B.C., Riot Micro has engineering offices in Waterloo, Ontario, and Irvine, California.

RELATED: AT&T: Jury is still out on NB-IoT

Riot Micro works with carriers for qualifying its chips on their networks but Wong declined to identify any specific operators. “We are talking to carriers across the globe,” he said. NB1 is getting a lot of traction in Europe, but it also is split like the U.S. in terms of support for NB-IoT and Cat-M1/LTE-M.

RELATED: T-Mobile’s Kuoppamaki explains carrier’s IoT deployment strategy for NB-IoT vs. LTE M

One of the big advantages for cellular over some other IoT technologies is it’s already widely deployed throughout the world in comparison to the unlicensed solutions. “There are a lot of advantages of cellular over this other stuff,” Wong said. Plus, “if you can bring power and cost down to the same points, why wouldn’t you do cellular?”