MWC 2023 turned out to be a graduation party for Samsung Networks, from a market disruptor to a mature, reliable and confident 5G infrastructure leader. This was evident from the flurry of announcements made around the event, including its own, as well as from operators and other ecosystem partners.

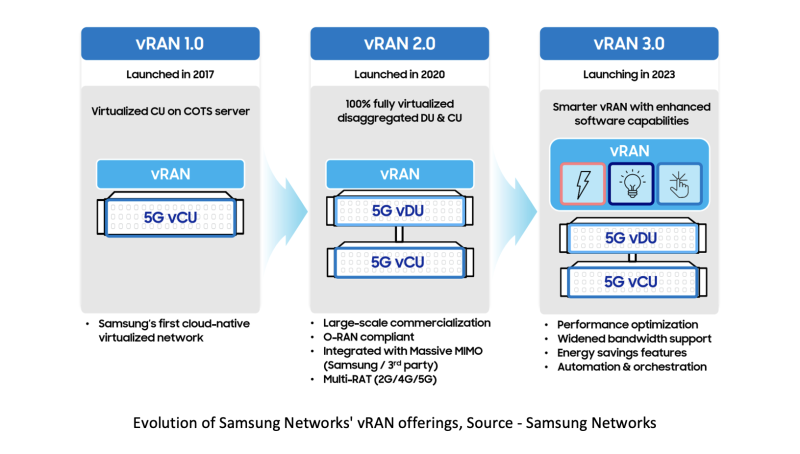

The announcement season actually started late last year when DellOro Group crowned Samsung Networks the vRAN/open RAN market leader. To top that, during MWC, Samsung Networks announced its next-gen vRAN 3.0, as well as many collaborations and partnerships.

To my credit, Samsung Networks followed the trajectory I outlined in this article in 2021. It has meticulously built and expanded its global footprint and created a sizeable ecosystem of partners that are technology and market leaders in their respective domains.

Next-gen infrastructure solutions

Unlike other large infrastructure vendors such as Ericsson, Huawei and Nokia, Samsung was an early and enthusiastic adopter of vRAN/open RAN architecture. Being a challenger and a disrupter made that decision easy — it didn't have any sacred cows to sacrifice, i.e., legacy contracts and relationships. That gave it a considerable head start that it continues to maintain.

The vRAN/open RAN transition is shaping up to be a two-step process: First, a disaggregated, cloud-native, single vendor, fully virtualized RAN (vRAN), with open interfaces, followed by a multi-vendor truly open RAN. Many of Samsung Network's competitors are still on the first step, deploying their first commercial base stations. In contrast, Samsung Networks has already moved on to the second step (more on this later).

Samsung Networks announced its next-gen solutions, dubbed vRAN 3.0, which brings many performance optimizations and significant power savings. The former brings a key feature that supports up to 200 MHz of bandwidth with 64T64R massive MIMO configuration. That almost entirely covers the mid-band spectrum of U.S. operators. The latter involves optimizing usage and sleep cycles of CPU cores to match user traffic, thereby minimizing power consumption. These software-only features (with the proper hardware provisioning) exemplify the benefits of a disaggregated vRAN approach, where the new capabilities can be rapidly developed and deployed.

Also, part of vRAN 3.0 is the Samsung Cloud Orchestrator. It streamlines the onboarding, deployment and operation processes, making it easier for operators to manage thousands of cell sites from a unified platform.

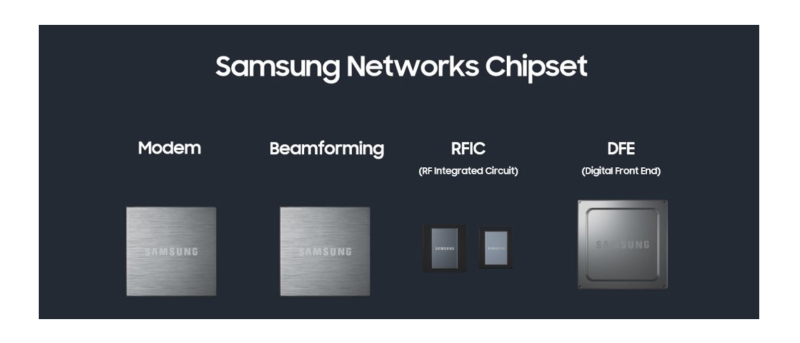

Although large parts of vRAN/open RAN are software-defined, the key radio technologies still reside in hardware. That is where Samsung Networks has a strong differentiation. It is the only major network vendor that can design, develop and manufacture 4G and 5G network chipsets in-house.

Strong operator traction and contract wins

Samsung Networks' collaboration with Dish Wireless is notable at many levels. Dish Wireless is one of the biggest open RAN greenfield deployments. Its trust in keeping Samsung Networks as a primary vendor says a lot. It is also a multi-vendor deployment, wherein Samsung Networks is integrating its own as well as Fujitsu's radio units (RU) into the network. Interestingly, Marc Rouanne, EVP and chief network officer of Dish Wireless, joined Samsung Networks' analyst briefing at MWC and showered lavish praise on their work together, especially on system integration, the Achilles heel of open RAN.

Vodafone has been a great success story for Samsung Networks. After successfully launching the U.K. network with the famous Golden Cluster and integrating NEC radios, both companies are now extending their collaboration to Germany and Spain.

In Japan, Samsung's Network's relationship with KDDI has grown tremendously. Leading up to MWC, they announced the completion of network slicing trials, followed by commercial 5G open RAN deployment along with Fujitsu (for RU) and a contract for 5G standalone core network, a first for Samsung outside Korea.

A recent Dell'Oro report identified North America and Asia-Pacific as the growth drivers for vRAN/open RAN. Although Europe is a laggard, even then, that region's revenue is expected to top $1 billion by 2027. Apart from the above announcements, Samsung Networks has announced many operator engagements and contract wins across these three regions over the years. So, geographically, Samsung Networks is putting the bets in the right places.

Expanding the partner ecosystem

Success in the infrastructure business is decided by the company you keep and the partnerships you nourish. That is even more true with vRAN/open RAN, where networks are cloud-native, software-defined, and multi-vendor, with open interfaces.

There was a long list of partner announcements around MWC 2023. The cloud platform provider VMWare is working with Samsung Networks for the Dish deployment. Another provider, Red Hat, announced a study that can save significant power for operators when their platform and Samsung Networks' RAN are working together.

Cloud computing provider Dell Technologies announced through its 5G Head of Marketing Scott Heinlein's blog a collaboration to integrate Samsung Network's vCU and vDU with its PowerEdge servers.

Finally, Intel, in its announcement, confirmed that Samsung had validated its 4th Gen Intel Xeon Scalable processors for the core network.

Again, these are just the MWC 2023 announcements. There were many more in the last few years.

In summary, through its differentiated solutions, strong operator traction and robust partnerships, Samsung Networks has graduated from a credible disrupter to a reliable, mature infrastructure player, especially for vRAN/open RAN. It was vividly on display with all its glory at MWC 2023 through its proven track record, product, operator, and partner announcements. I can't wait to see how its next chapter unfolds while global networks transition to new architectures.

Meanwhile, if you want to read more articles like this and get an up-to-date analysis of the latest mobile and tech industry news, sign-up for our monthly newsletter at TantraAnalyst.com/Newsletter, or listen to our Tantra's Mantra podcast. If you want to know more about the vRAN/open RAN market, check out these articles.

Prakash Sangam is the founder and principal at Tantra Analyst, a leading boutique research and advisory firm. He is a recognized expert in 5G, Wi-Fi, AI, Cloud and IoT. To read articles like this and get an up-to-date analysis of the latest mobile and tech industry news, sign-up for our monthly newsletter at TantraAnalyst.com/Newsletter, or listen to our Tantra's Mantra podcast.

Industry Voices are opinion columns written by outside contributors — often industry experts or analysts — who are invited to the conversation by Fierce Wireless staff. They do not necessarily represent the opinions of the Fierce Wireless editorial board.