We recently attended Fierce Wireless’ Private Wireless Networks Summit. Below are some of the small cell and private 5G related highlights from the presentation and the event as a whole.

Small cell scope is evolving

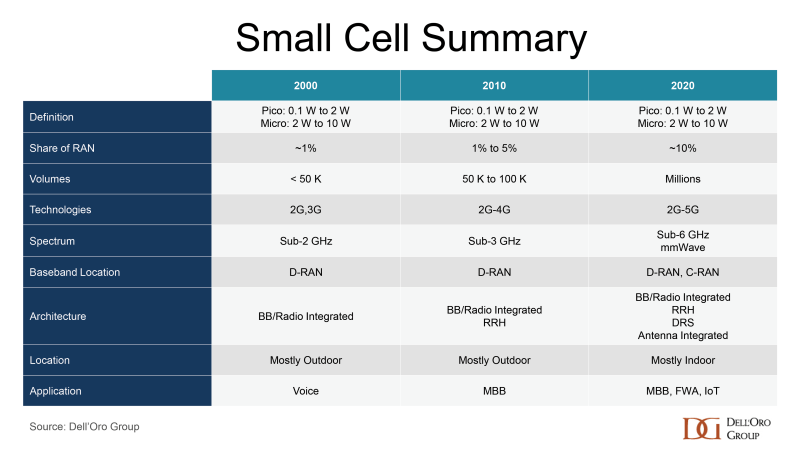

The concept of using low-power base stations to address coverage and capacity limitations with the macro network is not new. One of the messages we wanted to communicate at this event was that even if the definition we use at the Dell’Oro Group to classify small cells (RF output power ≤ 10W) has not actually changed much since we first started tracking pico and micro base stations in the year 2000, these low-power systems have evolved rather significantly over the past 10 to 20 years.

In addition to all the technology advancements required to support new radio interfaces and spectrum bands, the architecture and the form factor have changed quite a bit since the 2G/3G era, with a confluence of RRH, distributed, standalone, and antenna integrated low-power configurations now available.

Also, the scope continues to evolve and broaden the reach of small cells. In the current 5G era, small cells include Sub-6 GHz and mmWave solutions, higher order MIMO configurations, open RAN/proprietary RAN, and vRAN/purpose-built RAN. And perhaps more importantly, it is no longer just about operator driven mobile broadband (MBB) applications – small cells are expected to play a pivotal role advancing fixed wireless access (FWA) and proliferating 5G connectivity into enterprises and industries.

Where are we?

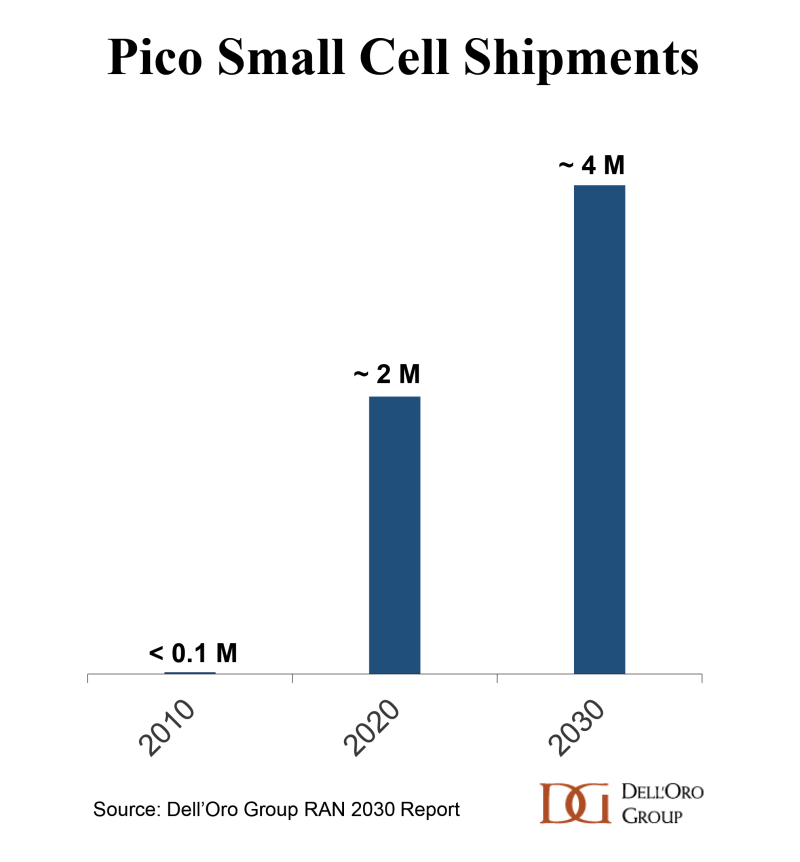

Small cells have come a long way since Alcatel-Lucent introduced the “LightRadio” at MWC 2011, promising a new economical and simplified way to boost capacity by building the networks from the inside out. As we now know, this vision with small cells proliferating rapidly in both public and enterprise settings, spurring changes to the vendor dynamics, has morphed over time. Although volumes are nowhere near some of the projections outlined in the early part of the 4G hype cycle, small cells are now a standard part of the larger RAN portfolio. They collectively comprise around 10% of the overall macro plus small cell RAN market.

One of the near-term challenges the industry is now coming to terms with is that small cell investments have been growing at a rapid pace for some time, and comparisons in some of the advanced markets are becoming more challenging, in part because the market has so far been mostly driven by a few sub-segments. This taken together with the more tepid uptake in other small cell regions and segments is impacting the overall growth rate. As a result, our analysis shows that the combined micro and pico small cell revenues advanced at a single-digit rate in 2022, down from the double-digit increases that shaped the small cell ascent over the past ten years.

The shift from LTE to 5G NR small cells has been mixed across the various small cell segments. However, in aggregate, 5G already accounts for more than half of the total small cell revenues, reflecting the wider scope and the need to shorten the upper mid-band deployment gap between macros and indoor systems.

Not surprisingly, the mix is still heavily tilted toward public small cell deployments. Private wireless is moving in the right direction but volumes remain small – we estimate private 5G small cells still account for a single-digit share of the overall public plus private 5G small cell market.

Who is benefiting?

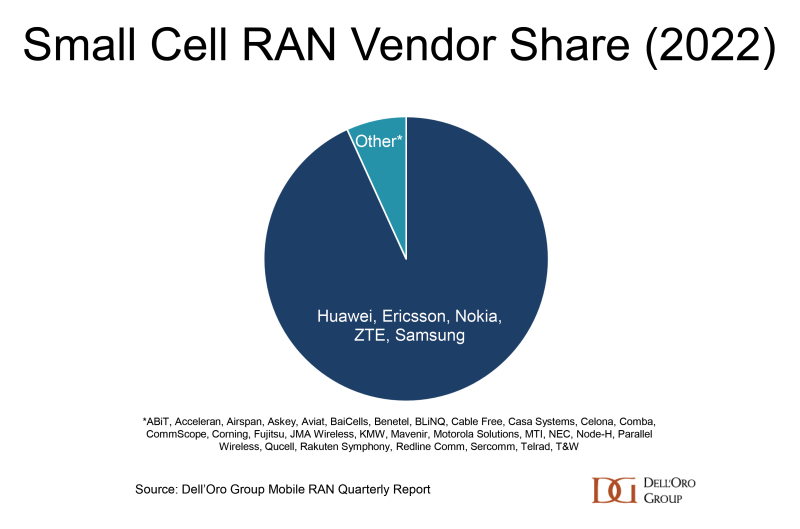

In contrast to the thinking in the early 4G days, small cells have not had a major impact on the supplier dynamics – the top five macro RAN suppliers are also the top five small cell RAN vendors. The long list of small cell pure plays that existed in the early 4G era has shrunk.

Activity among the smaller suppliers is picking up again as the expectations for private wireless are on the rise. In addition, various indicators suggest enterprises and operators are more willing to work with non-traditional vendors in some settings, especially if the public macro is operating in a different spectrum than the small cell.

One difference this time around vs. previous hype phases is that the vendors are more focused on a specific segment. In other words, there is an understanding that not all small cell opportunities are the same. And some are betting that they are more likely to succeed by targeting a smaller pie.

What is next?

Near-term growth is slowing but the long-term payoff looks considerable. In addition to new growth opportunities with FWA and Private 5G & IoT, we remain optimistic about the indoor MBB market as well. Even if most of the marketing is based on outdoor metrics such as POP coverage, base station volumes, and speed tests, the acceptable performance delta between the outdoor and indoor is also not infinite, especially when Wi-Fi is not available. Per Huawei’s HAS 2023 event, a 10x speed delta between the outdoors and indoors is now common in parts of China. Since China is leading the 5G NR small cell market, it is not inconceivable that the gap could be even higher in other markets. This taken together with the inevitable shift toward higher frequencies should raise the “minimum acceptable indoor performance” bar.

FWA is also a growth opportunity. So far, the public MBB network is addressing the lion’s share of the 100 M+ FWA connections. Over time, however, operators will need to explore the ROI of investing in more FWA-exclusive small cell builds.

One recurring theme across this event was the excitement about the growth prospects with enterprise/private wireless. The pivot away from pitching LTE/5G as a Wi-Fi+ complement/alternative in places where Wi-Fi is working toward selling LTE/5G where Wi-Fi or public cellular is not satisfactory is promising.

In other words, it might seem like the best days are in the rearview mirror. After all, growth is slowing and this small cell concept has been around for decades in different shapes and forms. The reality, however, is that it is early days in this small cell journey and the best days are still ahead.

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm's Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of the editorial board.