T-Mobile is now the carrier with the largest number of prepaid customers, surpassing Verizon.

Based on their Q3 2023 earnings reports, T-Mobile had 21,595,000 customers and Verizon had 21,420,000. Wave7 Research flagged the change in a prepaid report distributed to subscribers this week. (AT&T reported 19,391,000 prepaid customers as of the end of Q3.)

Before the third quarter, Verizon was the biggest U.S. prepaid carrier, but that title was relatively new. The operator bought TracFone Wireless from América Móvil in 2021, instantly giving it more than 20 million prepaid customers. But it’s been steadily losing customers ever since.

Verizon did not respond to a request for comment. T-Mobile confirmed it has surpassed Verizon “with our stable performance” in prepaid but did not offer anything further.

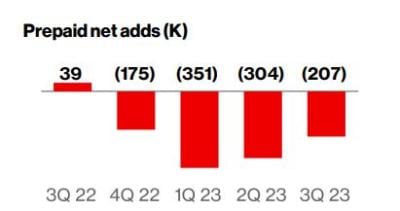

As BestMVNO recently pointed out, Verizon hasn't had a quarter of prepaid growth since Q3 2022, when it added 39,000 lines. Since the acquisition of TracFone, it’s lost more than 2 million subscribers.

TracFone was the biggest U.S. MVNO at the time of the acquisition. Some losses can be attributed to customers who were using the T-Mobile or AT&T network and didn’t want to switch; the majority of TracFone’s customers already were using the Verizon network.

Verizon’s history in postpaid

Historically, Verizon has been focused almost exclusively on postpaid, which makes sense because that’s where the higher average revenue per user or account (ARPU/ARPA) is generated, said 556 Ventures analyst Bill Ho, who tracks quarterly prepaid results.

However, with growth in postpaid growth slowing, it made sense for Verizon to reconsider its stance on prepaid and jump in head first. Ho suggested part of the prepaid losses may be due to Verizon intentionally letting lower ARPU customers leave in order to improve the bottom line.

That’s something Dish Network executives talked about during their Q3 earnings call on Monday, explaining part of their strategy is being more selective about obtaining and retaining profitable customers.

Although prepaid customers generally include those who pay in advance and don’t require a credit check, the line between prepaid and postpaid customers has blurred over the years. Prepaid customers look a lot more like postpaid, and a lot of them are moving to the postpaid category.

T-Mobile executives have talked about that shift for some time, and Ho said T-Mobile has reclassified some prepaid customers to postpaid, which makes the postpaid growth look better. If not for those reclassifications, T-Mobile likely would have surpassed Verizon’s total prepaid count much sooner.

T-Mobile will be adding more than 2 million more customers to its prepaid roster if its proposed acquisition of Mint Mobile and Ultra Mobile gets approved. The U.S. government is currently reviewing that deal, with the FCC asking T-Mobile to provide answers by November 29 on everything from public interest benefits to distribution plans.

Churn, churn, churn

Verizon’s prepaid churn was 4.39% in Q3. Ho said both AT&T and T-Mobile are doing a good job keeping their prepaid churn down – both are under 3% – but he thinks T-Mobile is doing a better job of understanding the prepaid base. “They know which levers to pull,” he said.

AT&T bought Cricket Wireless in 2014, and T-Mobile acquired MetroPCS in 2013. Cricket and MetroPCS had established stores in metro areas nationwide, something Verizon is just now starting to do with its Total by Verizon brand.

Going forward, Ho said he will be looking to see if Verizon turns the corner on prepaid and does so over more than one quarter. However, “I question whether they will have enough growth to offset their losses,” he said. “From an integration standpoint, it doesn’t look like a good acquisition.”

Marking progress

In recent earnings calls, Verizon CEO Hans Vestberg has talked about making progress with the TracFone integration. During the Q3 call, he said prepaid is important for Verizon’s overall strategy and he referred to opening new retail doors and working with national retailers to fortify its offerings.

Indeed, Verizon is making efforts to shore up its prepaid business, with Straight Talk offering discounts on family plans and actor and comedian Jim Gaffigan appearing in Straight Talk ads. Visible is digging in its heels to be a successful all-digital prepaid provider.

In addition, hundreds of Total by Verizon stores are opening across the country. During an interview with Fierce last month, Verizon Value President Angie Klein talked about Verizon’s 11 different prepaid brands and how they all play a slightly different role.

For example, most Walmart stores are not located in core downtown areas but are in more suburban or rural markets, and that’s where Straight Talk is focused.

Total by Verizon is more focused on urban and “tight suburban,” multi-cultural markets, competing directly with Cricket and Metro by T-Mobile.

“We think we can do that better and provide better and more premium solutions than some of our competitors are providing to this segment, so we’re looking to take them head on,” she said.