The irony is not lost on us. Despite being one of the critical U.S. industries at the center of the country’s current economic growth, the industry is beset on all sides with attacks from its own government. Let’s take a close look at just two of the most recent broadsides.

The FAA and C-band. Due to a failure of inter-governmental coordination, the 5G spectrum that the U.S. wireless companies paid $80 billion to use to provide faster and better mobile networks is in limbo. What was presented at auction as unencumbered spectrum, ready to be used by the end of 2021 and end of 2023, is anything but unencumbered. Not only are the companies unable to use the spectrum they paid for to offer higher speeds to public safety, schools, libraries, or small businesses for possibly up to 7 months after they had announced, they may never be allowed to use it the way the FCC told them they could before the auction.

Does the term “bait and switch” come to mind?

Seven months is not a long time, unless you have to pay interest on almost $69 billion paid for spectrum and around $13 billion for satellite incentive payments and relocation costs to be able to launch December, 20 2021. From this perspective, seven months is a really, really long time. Talk to any CFO.

So when the FAA began resurfacing the same issues that FCC and NTIA engineers had already evaluated and decided were not issues, the industry’s reaction was as you’d expect, alarmed. The industry has always played it safe, taking the conservative view on anything safety related, putting safety ahead of profit. The same may not be true of our friends in the aerospace industries. We are curious why that industry continued to install unsafe altimeters for years after the FCC announced the plans to allow C-band use for 5G. If what they allege is true, continuing to install unsafe altimeters is the height of ignoring consumer safety.

RELATED: FAA issues 5G warning, cites C-band ‘progress’

As I’ve written before, C-band networks in 40 countries are not causing any problems with active networks up to 3.8 GHz. The A-Block of the C-band auctioned in the United States is between 3.7 and 3.8 GHz – a full 500 MHz away from the altimeters the FAA is so concerned about. Nowhere in the rest of the world do the same planes, same networks, same altimeters have issues. American exceptionalism at its worst. Boeing in NPRM ahead of the C-band auction proposed a 100 MHz guard band and as a result the FCC created a 200 MHz guard band, and now the FAA believes a 500 MHz guard band isn’t enough… $1 billion in interest later we may or may not know the truth.

But back to the spectrum issues that the FAA delay may impact. Recall, part of the premium that Verizon and AT&T paid for the A Block C-band licenses was the ability to begin using the spectrum as soon as December 20, 2021. If the FAA delays deployment until mid-2022, the financial and economic consequences will be very real.

RELATED: The skinny on the top 5 C-Band winners

Taking out a loan for seven months – December 2021 to June 2022 – to finance $72 billion at 1.75% to 2.5% costs AT&T and Verizon $735 million to $1.05 billion. The economic fall-out from a seven-month delay doesn’t stop with the interest that has to be paid. As we have already discussed in February, 2021, not all spectrum is valued the same.

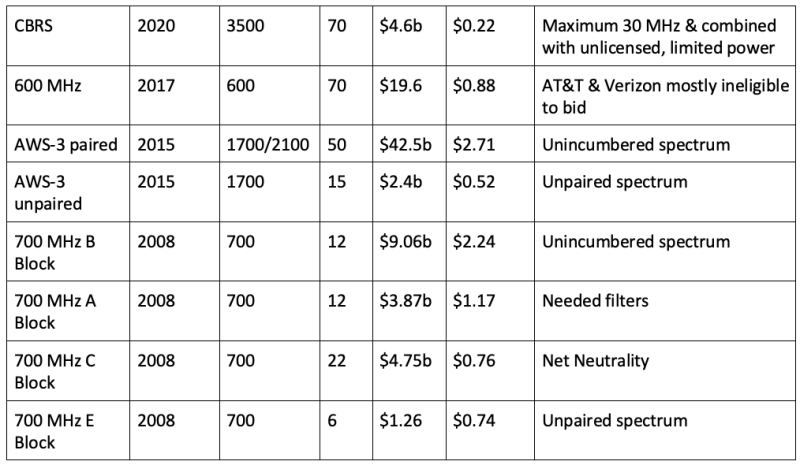

From the difference between the auction results of the CBRS Auction and the C-band auction it is clear that bidders were paying a significant premium (almost 4x) for C-band for similar propagation but without the sharing, potential interference and limited maximum spectrum block. In addition, when we compare the prices that the 700 MHz A-Block versus the 700 B-Block was able to achieve the lesson is clear.

RELATED: FAA is at blame for last-minute C-band concerns — Webb

The comparables indicate that if the C-band restrictions that are looming would have been known, the results for Auction 107 would have been between a half and a quarter of what was actually achieved. In other words, instead of $80.9 billion for the licenses plus $13 billion for the incentives, bidders would have bid between $24 billion and $47 billion. This is a meaningful amount. The license winners could consider going to court to either invalidate the auction or demand a discount corresponding to the decline in value post auction due to the unforeseen actions of the federal government.

The taxman cometh for mobile

If you think this FAA development was not bad enough, another whammy is smacking the wireless industry from behind.

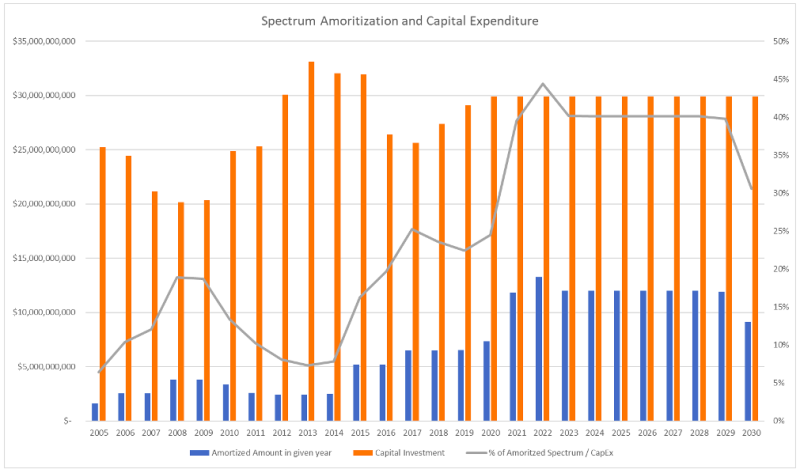

Up until now, license winners could amortize the cost of the licenses they won over a 15-year period. This allowed license winners to bid significantly more than they would otherwise have because they can deduct it from their taxable income over the 15-year period. These tax write-offs have ballooned from a modest $1.5 billion in 2005 to $11.8 billion in 2021 and are going to grow to $13.2 billion next year based on the Auction 110 results where the clock-phase just finished, and payments are due next year

In order to finance the Build Back Better bill, the House of Representatives passed a bill that eliminates the ability to amortize spectrum auction expenditures going forward.

While we certainly need to find ways to pay for new expenditures, the Senate should consider the consequences of this provision. As it is common knowledge, the stock prices of all the wireless service providers in the United States are under a lot of pressure. Wall Street has not yet recognized the Damocles sword hanging over the industry as it is faced with the unenviable choice between reducing EBITDA profits by $13 billion, representing roughly 13% of industry EBITDA, cratering earnings per share or reducing capital investment by the same amount to keep profitability unchanged.

Reducing pre-tax profits by $13 billion will incite an investor revolt, tank their company valuation, and force current management at all operators to be removed from their jobs. Furthermore, the valuation of American telecom providers will drop so significantly that all of them instantly will become take-over targets by foreign investors.

A decline of $13 billion of capital expenditures represents approximately 44% of 2020 capital expenditures. An expected decline to $17 billion industry-wide capital expenditures was seen the last time in 1994. The competitiveness of the U.S. economy will be impacted as other countries will not slow down their 5G network build out just because the U.S. decided to make things harder for its U.S. wireless carriers. The least of our problems will be the 60,000 to 70,000 jobs that will disappear due to the slowed network build out.

I have written about what happens when a country or region loses wireless leadership. One related sector next to wireless dies. We saw this with our wireless infrastructure after the U.S. lost out when it was unable to keep its 1G leadership with the transition to 2G; Europe lost its mobile handset industry after it lost 2G leadership when 3G was rolled; and Japan lost its mobile software leadership after it wasn’t able to translate its 3G leadership into 4G leadership.

The U.S. gained 4G leadership and has been competing with China on who will be the leader in 5G. It will be no competition when U.S. carriers will have their financial foundation pulled from underneath them by having to pay tens of billions more than what the spectrum is worth and lose the ability to amortize their vast spectrum expenditures. We should not be surprised when the next spectrum auctions will yield a small fraction of the recent $80.9 billion auction.

We need to keep the incentives to build out wireless networks intact. Money that goes to spectrum that isn’t as valuable as it was presented to be or de facto tax increases take away money from building out wireless networks. Without great wireless networks, the digital divide in this country, and compared to other countries, will not move in the way that is beneficial for the American economy and people. We need to invest in the future, not make it harder.

Roger Entner is the founder and analyst at Recon Analytics. He received an honorary doctor of science degree from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger on Twitter @rogerentner and catch him on The Week with Roger podcast.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not represent the opinions of Fierce.