During the fourth quarter 2023, the top three wireless operators in the U.S. reported a total of 1.78 million new postpaid phone subscribers. And while the analysts who are allowed to ask questions on the earnings calls don’t seem at all phased by these numbers and in fact expect the operators to continuously grow subscribers, the editors at Fierce Wireless are scratching our heads: How can each carrier report growth in postpaid phone subscribers each quarter in a country whose population is not growing very much?

We reached out to Recon Analytics analyst Roger Entner who said that question is top-of-mind among the operators, who pay Recon substantial sums of money for survey data to try and figure out the answers. They’re particularly interested in the postpaid phone subscribers that the cable operators are gaining.

Meanwhile, each of the three wireless operators continues to report subscriber growth. In Q4, 2023:

- T-Mobile reported 934,000 postpaid phones

- AT&T reported 526,000 postpaid phones

- Verizon reported 318,000 postpaid phones

According to the U.S. Census Bureau as of December 19, 2023, the nation gained more than 1.6 million people in 2023, growing by 0.5% to 334,914,895. The year’s national population growth was still historically low but was a slight uptick from the 0.4% increase in 2022 and the 0.2% increase in 2021.

Still, with growth of 1.6 million people, did every one of those people who were either born or migrated to the U.S. in 2023 immediately run to a wireless store and buy a new postpaid phone subscription? Doubtful.

We’ve heard several general explanations for why postpaid phone subscriber numbers constantly grow.

- More children are getting their own phones;

- Businesses are subscribing to more wireless lines;

- Postpaid is cannibalizing prepaid.

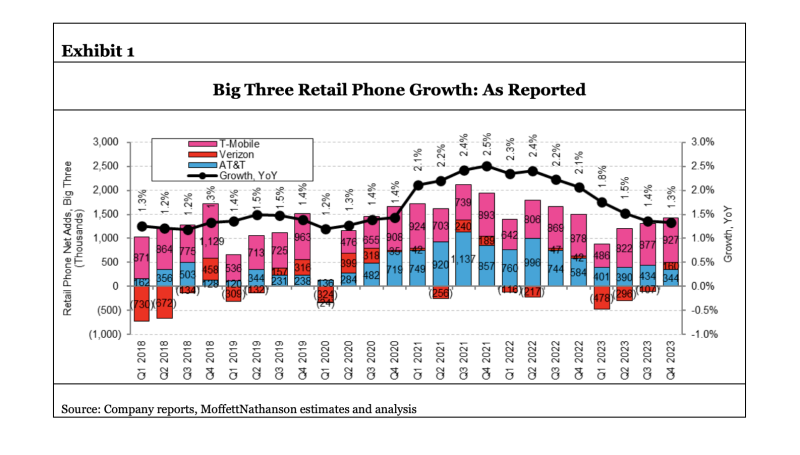

The analysts at Moffett Nathanson pointed out that total phone (including both pre-paid and post-paid) subscriber growth for the Big Three has actually slowed from 2.1% in the fourth quarter of 2022 to 1.3% in the fourth quarter of 2023.

There’s also the fact that the wireless operators, and also cable MVNOs, sometimes give away free postpaid phone lines for promotional purposes. The cable MVNOs have been offering free lines to their broadband subscribers for one year to try and get them hooked. On its Q3 2023 earnings, Altice USA reported that after its MVNO customers rolled off the free promotional year, about 60% of them converted to a paying mobile plan.

That may make good sense for cable operators.

But T-Mobile sometimes offers free lines that subscribers want (for some reason) but that they don’t activate.

Entner said, “Operators issue free lines because people like it, and it’s a churn inhibitor.”

But is it fair to compare the postpaid phone net adds of an operator that has issued free, unused lines to an operator whose lines are all paid?

How important are postpaid phone net adds?

Referring to postpaid subscriber phone adds in 2024, the analysts at Moffett Nathanson said 2024 provides a very narrow lane for the wireless operators to “even meet, much less beat expectations on what is, for better or worse, always the most important metric.”

But Entner argues that perhaps subscriber counts are a relic from two decades ago when the wireless industry “was awash in losses, and they needed to show that something was growing.”

He added that now, we’re in a mature environment, and the operators are focusing more on their financial objectives. He said if this were the pastry industry rather than the wireless industry, would analysts look at how many Sara Lee cookies were sold, or would they focus on the company’s revenue?

But on the other hand, customers are the lifeblood of a company.