Verizon expects to win 4 million to 5 million fixed wireless access subscribers by the end of 2025, as nationwide broadband for both business and consumers represents one of its key areas for growth.

Verizon executives highlighted the opportunity for FWA throughout its investor day presentation Thursday, including the expectation to bring in 150,000 subscribers in the first quarter of 2022 – double what the carrier recorded in the fourth quarter of 2021.

It handily surpassed coverage targets as it now counts 30 million households covered by FWA including 2 million businesses. Looking ahead plans call for 50 million homes and 14 million businesses covered by the end of 2025.

Capacity challenge?

As carriers Verizon and T-Mobile push into the home broadband market with fixed wireless offerings, both 4G and 5G, some have raised questions about capacity constraints as heavier home usage could take up resources from higher-value mobile users.

But Verizon doesn’t expect to have any issue. During Thursday's presentation, CTO Kyle Malady called out end-to-end bandwidth with its intelligent edge network (complemented by fiber build) and additional spectrum in the RAN.

“We have the capacity to handle 1 million fixed wireless access, 4 to 5 [million] over time,” he said. “I feel very good about where we are in terms of capacity, it’s not a problem for us like it was 20 years ago when we only had a limited amount of spectrum.”

RELATED: Verizon beefs up C-band deployment to 175M by end of 2022

Thanks to its C-band winnings, plus CBRS, and arsenal of millimeter wave, Verizon now has large swaths of key 5G spectrum bands. It’s deployed 60 MHz of C-band in major markets and will have 161 MHz on average nationwide once the second tranche is ready in the 2023 timeframe.

“We have a lot of spectrum, we’ve cracked on the code on millimeter wave for the densest urban areas which was always the problem, and our core is really robust and getting more robust,” Malady said.

It’s looking to utilize underused capacity with FWA and drive new revenue streams. Network engineering is part of the picture, as is the huge amount of capacity new C-band spectrum is adding along with existing millimeter wave, and complementary hours of peak usage for mobile and fixed wireless users (the mobile network is used heavily during the day, while home usage peaks in the evening), he explained. And according to Malady, another less talked about factor is the efficiency gains built into 5G specifications and driven by evolution of antenna technology like massive MIMO that basically allows the network to handle a lot more traffic while utilizing the same amount of resources.

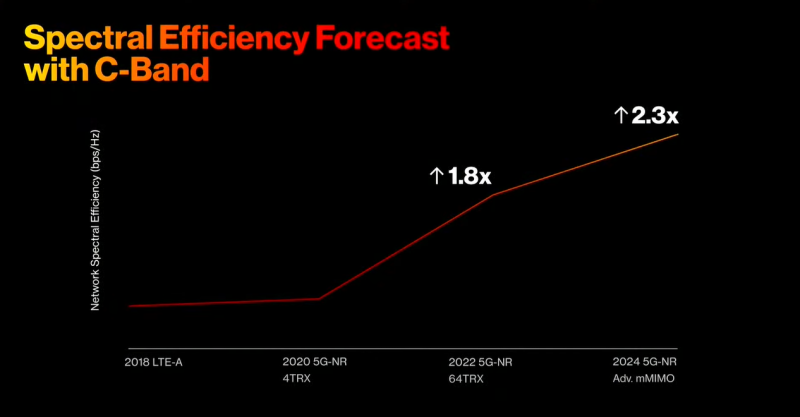

Malady said Verizon’s 5G Ultra Wideband network delivers greater than 1.8x more bits per hertz than LTE.

“In other words, our 5G spectrum is passing 80% more information in the same amount of spectrum, and we have more room to increase this to 2.3x in the next two years,” he said. “This gives us even more spectrum capacity to handle both fixed wireless access and mobility growth.”

Combination of the factors allows Verizon to be more capital efficient in the face of significant data usage growth he said, while taking advantage of the network capacity for more hours of the day during different times to support different use cases.

RELATED: T-Mobile’s FWA taps unused mobile capacity, which has its limits

During the investor day the carrier announced an accelerated C-band mobile coverage timeline for 2022 of 175 million, which he said will provide more opportunities for the consumer and business groups to boost their respective FWA efforts.

Broad based interest

Interest in fixed wireless has been broad based, according to CFO Matt Ellis, from both business and consumer and across urban, suburban and rural geographies. It’s also getting attention from both those that are existing wireless subscribers and those that don’t have a mobile relationship with the carrier.

Consumer group CEO Manon Brouillette said that importantly, FWA allows Verizon to attract customers that weren’t with the carrier before – noting about 30% of FWA customers fall into that camp.

“So what the team is focusing on is that when we activate them on broadband, we have to activate mobile at the same time … since they don’t have mobile with us,” she said. “It’s a huge hook for us to not only grow broadband but grow mobile as well, so we no longer rely only on the switcher pool doing that.”

And Verizon isn’t only going into areas where there’s no choice for broadband. Brouillette said “it’s really urban and suburban” and that the company is attracting customers from cable MSOs or other competitors. She reiterated that Verizon sees a lot of FWA potential and will revisit guidance next year.

In terms of what the carrier is seeing so far for fixed wireless, “I’m very happy, I could just say that,” she added.

And when it comes to economics, Ellis said with the 5G build, the incremental cost to serve FWA customers is very low while providing owners economics to deliver incremental FWA revenue at attractive margins and enabling strong EBITDA growth.

Across its five growth categories, Verizon expects to generate annual service and other revenue growth of 4% in 2024 and beyond, growing from around 3% in 2022. While 5G mobility is still going to be the largest vector driving that, nationwide broadband is the second driven by FWA, as well as Fios. Others include B2B and mobile edge compute (MEC), the value segment with prepaid and Tracfone, and network monetization. It also disclosed strategic partnerships, such as Meta, and a private wireless collaboration with Celona.

Wells Fargo analysts noted that the outlook for FWA subscribers might look modest, "but it's still a fairly big lift."

Considering T-Mobile's forecast of adding 7 million to 8 million FWA customers by 2024, they said together the carriers would need to gain upward of 10-12 million.

"In a broadband market that typically adds +3-5MM subs per year, with cable and fiber-to-the-home fiercely competing, that is certainly no easy task," wrote Wells Fargo analysts led by Eric Luebchow in a Friday note to investors. "We do think VZ will have success outside of urban corridors where fixed broadband competition is most aggressive" they continued.

Business playing where cable can’t

While Verizon may be going head to head with cable on the consumer FWA side, Verizon Business CEO Tami Erwin said for business, its mix of mobile and fixed wireless means it can go where cable can’t.

FWA represents a “huge expansion opportunity” for the relationship with business customers because it extends beyond just pure broadband replacement.

“We’re moving into new categories of growth, growth where quite frankly cable isn’t playing because of the mobility play,” she said. That could include construction sites, food trucks on college campuses, Covid testing locations, or other scenarios where customers need to move capabilities from site to site with different applications for high-speed data throughput.

After adding around 100,000 FWA business subscribers in 2021, Verizon projects growing to 1 million by the end of 2025.