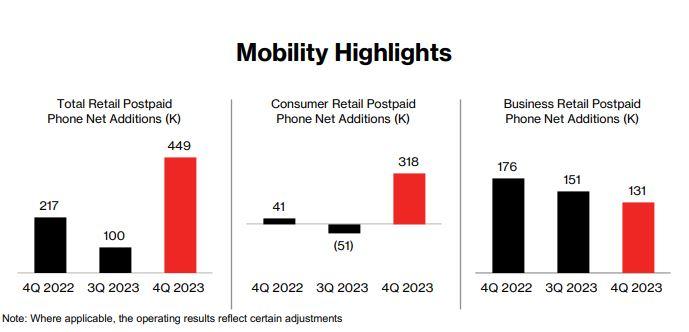

Verizon may be turning the corner on the losses it’s been seeing in its Consumer division, reporting 318,000 postpaid phone net adds for the fourth quarter of 2023. It was the first after a series of down quarters where its postpaid phone net adds were up in the Consumer group.

The fourth quarter historically is a good one for wireless carriers, so while moving in the right direction, it will be a while before Verizon is officially out of the danger zone.

Overall, 2023 showed signs of improvement. “We made significant changes to how we operate and to our team,” said Verizon CEO Hans Vestberg during the Q4 earnings conference call Tuesday. “Those changes paid off,” stabilizing the core business and positioning the company for renewed growth and profitability.

“We built strong momentum quarter after quarter, culminating in a very good holiday season,” he said. “Entering 2024, Verizon stands ready to further unlock our performance potential at an accelerating rate,” with the right assets and “the best team in the business.”

Indeed, Vestberg’s management team is mostly new compared to a year ago. Last March, he overhauled the structure, putting Sowmyanarayan Sampath in charge of the Verizon Consumer Group and Kyle Malady at the head of the Business group.

The consumer group was particularly in disrepair, and Vestberg attributes the turn-around in part to new management, including Sampath’s more localized approach to the market structure, as well as the introduction of MyPlan in May.

The consumer net adds of 318,000 were certainly better than what most Wall Street analysts had expected for Q4 from Verizon. The company also noted that consumer postpaid phone gross additions in the fourth quarter of 2023 increased 16.9% year over year, the best performance in four years.

Total wireless service revenue in Q4 2023 was $19.4 billion, up 3.2% year over year, driven in part by price increases, higher premium price plan adoption and growth from fixed wireless access (FWA) offerings.

The consumer net additions in FWA totaled 231,000 in Q4, which some analysts described as a little “soft.” Combined with the business segment, total FWA adds were 375,000, ending the year with just over 3 million in the FWA base.

Full-year 2023 capital expenditures were $18.8 billion, down from $23.1 billion in 2022. The company expects cap ex in the range of $17 billion to $17.5 billion for 2024.

Consumer wireless retail postpaid churn was 1.08% in Q4 2023; wireless retail postpaid phone churn was 0.88%.

In the Business group, Verizon reported 292,000 wireless retail postpaid net additions in Q4 2023, including 131,000 postpaid phone net additions. It was the 10th consecutive quarter that Business reported more than 125,000 postpaid phone net additions.

Wireless retail postpaid churn in the business segment was 1.48% in Q4 2023 and wireless retail postpaid phone churn was 1.12%.

Prepaid losses continue

The prepaid group is still not doing well and continues to lose customers. Verizon reported 289,000 wireless retail prepaid net losses in Q4 2023.

“The TracFone acquisition has been, to be blunt, a disaster,” wrote MoffettNathanson analyst Craig Moffett in a report for investors today.

Verizon acquired TracFone in 2021 and has been losing customers ever since. A couple bright spots in that division are Visible and Total by Verizon, which have been singled out as among the most promising of the many prepaid brands now at Verizon.

Looking ahead

New Street Research (NSR) analysts boiled it down to two questions: Will Verizon’s strong performance in the consumer segment continue and who is paying for it?

On the first question, net adds will “undoubtedly be negative next quarter, as they always are, but we would expect adds to be better year-over-year every quarter next year with a strong cadence that they will be positive for the year,” NSR said. “This is better than consensus expects.”

On the second question, that’s difficult to tell until Verizon’s peers report their Q4 results; AT&T is due to provide Q4 results tomorrow and T-Mobile on Thursday. “Anyone looking for a big beat from T-Mobile should temper expectations,” said NSR’s Jonathan Chaplin, noting NSR and consensus expectations of 880,000 net adds from the T-Mobile.

“We would expect momentum at AT&T to continue slowing. There is a big gap between their consumer NPS and their wireless net adds, which suggests to us that the strength is coming from business. We suspect that Verizon is gaining ground in Consumer, and while Business may remain strong for a while it will be difficult for it to get better.”