It’s been more than three months since reports circulated that Vodafone U.K. was in discussions with Three U.K. about a potential merger, yet no formal announcement has been made.

Nevertheless, Charu Paliwal, a research analyst with Counterpoint Research, wrote in a blog post that a mega-merger between the two U.K. operators may still be in the works because both companies are dealing with weakened bargaining power when it comes to purchasing 5G network equipment (due to the ban on using equipment from Chinese vendors Huawei and ZTE), and they are also facing increased competition in the enterprise segment, particularly when it comes to private networks.

For example, Verizon Business recently was awarded a contract with Nokia to deploy a private network for the Port of Southampton instead of a U.K. mobile network operator. “Such deployments reflect there is an emergence of new private network operators, and enterprises do not solely rely on traditional MNOs for connectivity services,” Paliwal said in an email exchange.

Plus, Paliwal added that Vodafone U.K. and Three are both dealing with financial pressures. Activist investor Cevian Capital, which owns a stake in Vodafone, is said to be pushing for an overhaul of the company to improve its revenues, and Three has reported flat revenue growth for the last few quarters.

However, Paliwal admitted that it’s difficult to predict if and when a merger between the two companies will occur. “It is difficult to say that a merger will happen within this year as we are yet to hear any formal announcement from the operators. Moreover, it will be a long shot as there will be strong scrutiny from regulatory bodies,” she said.

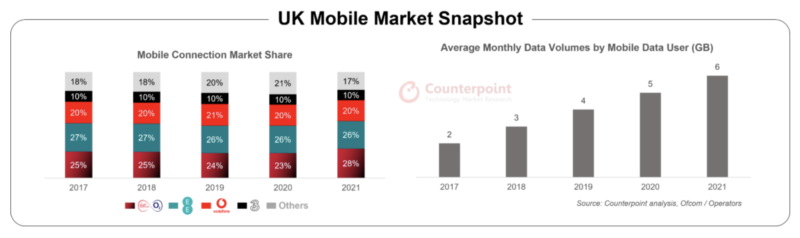

If the merger were to happen, it would reduce the number of mobile network operators in the U.K. from four — Vodafone, Three, EE and Virgin Media O2 — to just three. Counterpoint estimates that Vodafone has about 20% of the U.K. mobile market today and Three has about 10% of the market. If the two were to merge, the combined company would have a 30% stake in the U.K. mobile market, giving it a slight lead over Virgin Media O2 that holds about 28% of the market and EE that holds about 26%.

But Paliwal said that regulators may be more amenable to a merger now than they were a few years ago because of the pandemic and other reasons. “It is the factors such as limited organic growth in the competitive U.K. market, sustainability of operators in view of high level of 5G investments, importance of connectivity services especially after the pandemic and potential improvement in quality of services that can compel regulators to take a lenient stance than in the past,” she said.

Paliwal added that one big benefit of the merger would be the ability for the operators to pool resources such as sharing the radio access network (RAN). This would likely be viewed favorably by the U.K. government, which has been a strong proponent of open RAN.

On the spectrum front, the two operators both hold significant mid-band spectrum giving the combined company 70 MHz of spectrum in the 3.4 GHz band and 120 MHz in the 3.6 GHz band. Three also holds 40 MHz of 3.5 GHz spectrum and 20 MHz of 700 MHz spectrum.

The reasons regulators may take a favorable view of a merger between Vodafone U.K. and Three are much different from the rationale behind the 2021 merger of O2 and Virgin Media. That merger, was touted for its ability to offer consumers more converged products and bundles because the two companies could combine mobile, broadband, landline and TV services.