One of the cool features of the Recon Analytics Mobile Intender Service (RAMIS) is that it not only gives us visibility of what the nationwide network providers are doing and how this impacts consumers and their behavior, but also provides a similar view on how smaller providers are performing. These small prepaid providers are one of the hardest to research service providers due to their size and the make-up of their customer base.

The smallest provider for whom we do not have meaningful insights is Ultra Wireless, a prepaid provider with an estimated 750,000 customers, a significant proportion of whom are primary Spanish speakers.

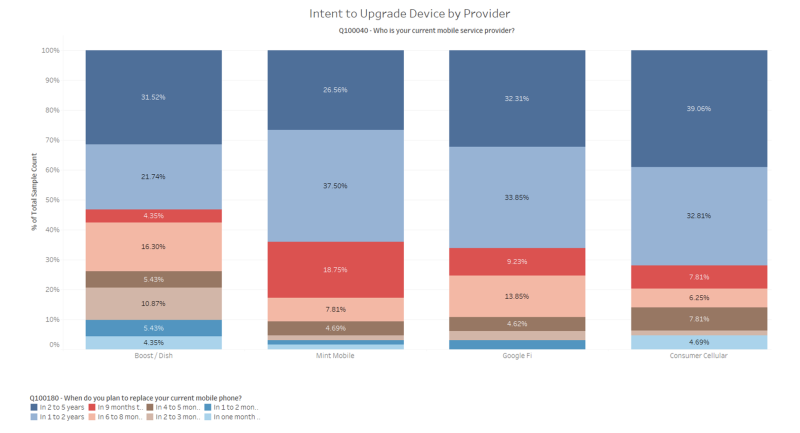

The chart below with data from April 2022 shows the results of questions we asked mobile customers about their mobile device intentions. It is very interesting how heterogeneous their plans were depending on the mobile service provider they were using.

Boost Mobile’s customer base is much more interested in upgrading their device than those of Mint Mobile, Google Fi and Consumer Cellular. This was also mirrored in how important Boost Mobile considered handset promotions as a driver in selecting a service provider.

Mint Mobile, the fast-growing MVNO partially-owned by movie star Ryan Reynolds, has a younger demographic than the other prepaid providers, and its customers are driven to a much larger degree by price and speed than those of other prepaid providers. If Mint Mobile is able to communicate the speed advantages of newer devices, it can probably materialize higher device sales as it has a substantial group of customers who are planning to buy a new mobile phone in nine to twelve months – in line with the next device upgrade cycle at Apple and Samsung.

It is surprising that almost two-thirds of Google Fi customers, the MVNO launched by a company that sells mobile phones, are planning to upgrade their mobile phone in more than a year. There are also some other stats that show how much more Google could do if it were to treat Google Fi as more than just a glorified field trial of its mobile core offering.

Consumer Cellular, which is co-marketed with AARP, has one of the highest satisfaction scores according to our data by properly focusing on their customer base. Their customer base, unsurprisingly, hangs on to their phones longer.

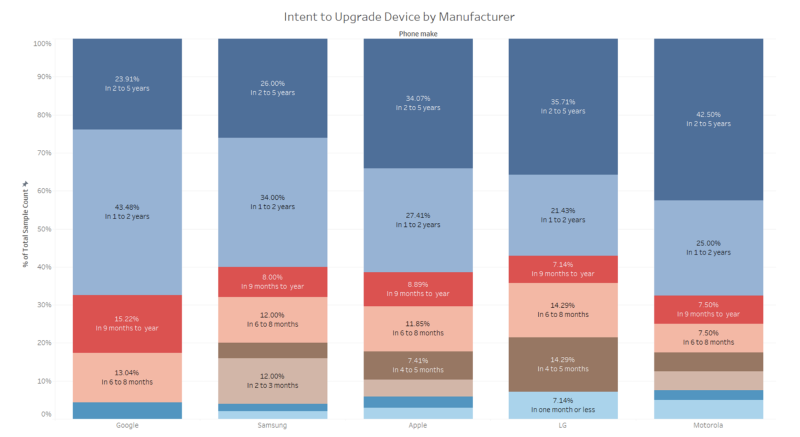

We can also look at the mobile phone upgrade intentions of Boost Mobile, Mint Mobile, Google Fi and Consumer Cellular customers combined by device manufacturer. The data shown below has limited interpretive power to explain how other mobile service providers’ customers are planning to upgrade.

On August 15, 2021, LG announced that it would exit the mobile phone market, forcing its current customers to look for another mobile phone choice when they upgrade their device the next time. LG’s customers are following the manufacturer to the exits with the highest intent to get a new mobile phone among the prepaid customers of Boost, Mint, Google Fi and Consumer Cellular. While LG customers have the most urgency to get a new device, almost 50% of LG smartphone owners still want to wait more than a year to replace it.

The tendency of a large part of the population to hold on to their smartphones for an extended period is stronger among prepaid subscribers than postpaid subscribers. Google device owners, regardless of service provider, have less urgency to upgrade their devices, partially due to the longer software support that Google provides to its phones.

With the Pixel 6 onwards, Google is providing five years of security upgrades. This is a significant factor for the consumers who plan to hold their device until obsolescence.

When we look at both Apple and Samsung device owners, it is interesting to see how similar they are. For both of them, 60% of their device owners want to upgrade their device in a year or more. Furthermore, both have around 20% of owners who want to upgrade in the next 6 months. That would get us right around Black Friday and the Holiday sales season, which is rife with promotions.

The insights get even more powerful when we combine them with what phones consumers plan to buy next, who is committed and who’s not to the next phone and combining that with purchase decision factors , switching intentions as well as a whole series of other metrics we collect.

Roger Entner is the founder and analyst at Recon Analytics. He received an honorary doctor of science degree from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger on Twitter @rogerentner.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not represent the opinions of Fierce.