Verizon’s deployment of mid-band spectrum for 5G is delivering boosts to download speeds for users connected to C-band, according to new analysis from Opensignal – getting the carrier closer as it works to catch up to speed leader T-Mobile.

Verizon and AT&T both started activating C-band spectrum in the 3.7 GHz range on January 19. AT&T acknowledged a more limited deployment in just eight markets, while Verizon had a more widespread launch with 5G Ultra Wideband using C-band now covering more than 100 million people.

Both are still only using a portion of their C-band holdings.

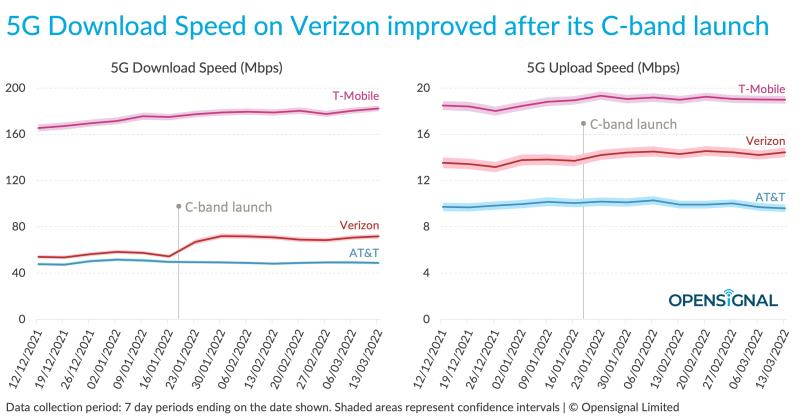

Opensignal results show that C-band, while still limited to certain major markets, was enough to bump Verizon’s overall 5G nationwide download speeds (which include lower band spectrum as well) immediately, even though T-Mobile still has the fastest thanks to its head start deploying mid-band 2.5 GHz. However, when only looking at connections on mid-band spectrum Verizon is closing the speed gap where it’s available, and a look at five cities shows it’s sometimes matching T-Mobile on speed.

Specifically, Opensignal saw C-band make enough of a difference to increase Verizon’s national 5G download speed score by about 15 Mbps or 26.7% after launch. It rose from the average of 55.7 Mbps seen on Verizon 5G in the six weeks prior to the January activation to an average of 70.6 Mbps afterwards. On a nationwide basis across spectrum bands, T-Mobile was still the clear 5G speed leader. The report didn’t show an impact on AT&T’s nationwide 5G experience since rolling out C-band.

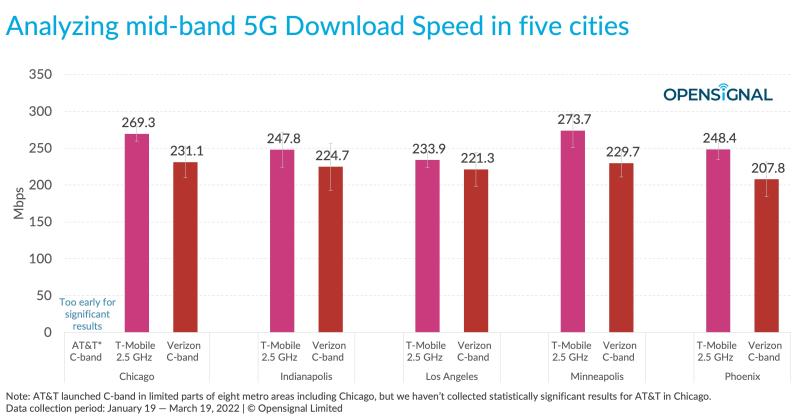

But when users are connected to Verizon’s C-band spectrum (now available across 1,700 towns and cities), speeds were much faster and competition for the top position is clearly heating up between the two. Opensignal collected data between January 19 and March 19, for U.S. mid-band 5G speeds. On average users on T-Mobile’s 2.5 GHz mid-band saw 5G download speeds of 225.5 Mbps, while Verizon users on C-band saw 211.8 Mbps. AT&T users on C-band also experienced a speed boost, with average 5G downloads of 160 Mbps – but again, only available in eight markets.

Ookla results from February right after Verizon’s C-band launch also showed impressive speed improvement from the mid-band spectrum just a week after activating.

In Opensignal’s latest analysis Verizon scored the fastest 5G upload speeds for users connected to mid-band spectrum, at 20.7 Mbps, compared to AT&T at 18.5 Mbps and similarly T-Mobile at 18.2 Mbps.

Opensignal noted that although Verizon’s mid-band experience is somewhat similar to T-Mobile, the two are not directly comparable yet. Still, the report offers additional evidence to claims that mid-band spectrum is key for a better 5G experience. Earlier Opensignal results showed how T-Mobile saw a more than 40% 5G speed increase between March and September 2021 for users connected to 2.5 GHz.

Drilling down into five specific cities, C-band spectrum made a marked difference in upping Verizon’s download speeds, which according to Opensignal were around four times faster (and all above 200 Mbps) than the carrier’s previous average 5G download speeds of about just 50 Mbps when users were connected to its nationwide 5G that largely uses lower band spectrum.

The cities included Chicago, Indianapolis, Los Angeles, Minneapolis and Phoenix. AT&T was left out of the city comparison because it hasn’t launched in those markets except for Chicago, where Opensignal was unable to collect any statistically significant results for the carrier.

T-Mobile still led the markets with a range of 233.9-273.7 Mbps 5G downloads on 2.5 GHz, but not by a ton, compared to Verizon’s range of 207.8-231.1 Mbps. In Indianapolis and Los Angeles, the two carriers’ mid-band 5G speeds were statistically similar.

All eyes on mid-band

T-Mobile’s advantage from getting its hands on key mid-band spectrum, which provides a favorable mix of both coverage and capacity, back in 2020 from its Sprint merger has been propelling it to the top of third-party 5G network speed testing results. Verizon, which has historically competed and commanded a premium on the basis of network superiority, spent big to acquire C-band spectrum and prioritized first-available licenses, in part to close the gap with T-Mobile.

As Opensignal noted T-Mobile has been gradually increasing the amount of mid-band spectrum deployed up to as much as 60-80 MHz in September, and T-Mobile President of Technology said at the time it was targeting 100 MHz by the end of last year. T-Mobile also has a near-term opportunity to purchase additional 2.5 GHz licenses, with the next FCC auction scheduled to start in July – with several of the asks that T-Mobile had been pushing for. And like AT&T, T-Mobile also came away with winnings from the recent 3.45 GHz auction where Verizon sat out.

For the initial C-band launch Verizon had 60 MHz in 46 major markets to deploy, while AT&T acquired 40 MHz. Both hold additional spectrum licenses that will become available later after satellite operators clear the band, expected in the 2023 timeline. For Verizon that means eventual access to a full 161 megahertz on average nationwide, with anywhere from 140 to 200 megahertz depending on the market.

But Verizon is already prepared to deploy more C-band in additional markets this year. Earlier this month it reached agreements with satellite operators for accelerated clearing timelines, meaning the carrier can deploy between 60 MHz and up to 100 MHz in at least 30 additional markets, including high population areas and some more rural locations.

That ties into Verizon’s increased coverage targets, which were recently upped, aiming to reach 175 million people with mid-band 5G by the end of 2022. T-Mobile’s Ultra Capacity 5G mid-band service already covers 210 million people, with the expectation to reach 260 million by the end of 2022.

In addition to the amount of spectrum, Verizon’s Bill Stone has also pointed to the carrier’s use of the latest Massive MIMO technology in 64T64R configurations as improving both performance and coverage of its C-band spectrum for 5G. On C-band alone, Stone, speaking on a Recon Analytics podcast, cited seeing greater than 900 Mbps, and when adding carrier aggregation into the mix greater than 1 Gbps.

And AT&T, although a limited early mid-band launch, expects deployments to ramp up in the middle of this year – when it also will have newly acquired mid-band in the 3.45 GHz range on hand. The carrier has held off as it plans a “one-climb” tower strategy and deploy both C-band and 3.45 GHz at the same time.

“While it may be some time before the two carriers can challenge T-Mobile for the 5G Download Speed award — as T-Mobile has had a nearly 22-month head start with its 2.5 GHz spectrum — Opensignal data shows that Verizon and soon AT&T now have the required mid-band spectrum to start the chase,” concluded Opensignal, noting AT&T and Verizon saw three to four times faster 5G download speeds when connected to mid-band than prior to rolling out the new spectrum.