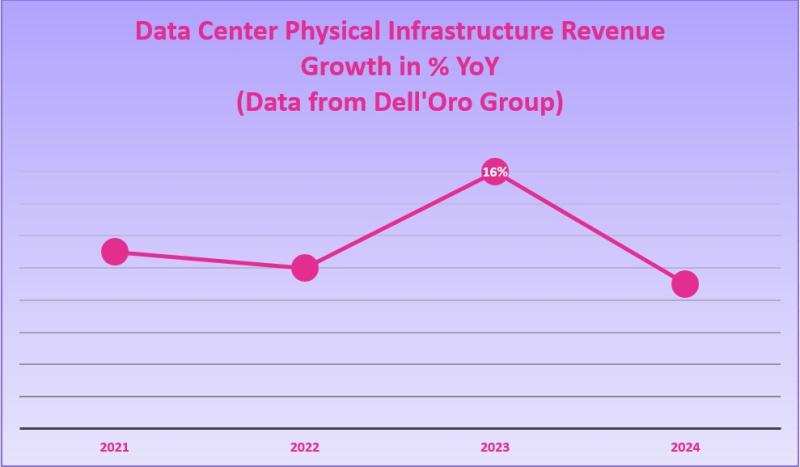

DCPI revenue growth hit a high in 2023, but a slowdown is expected in 2024

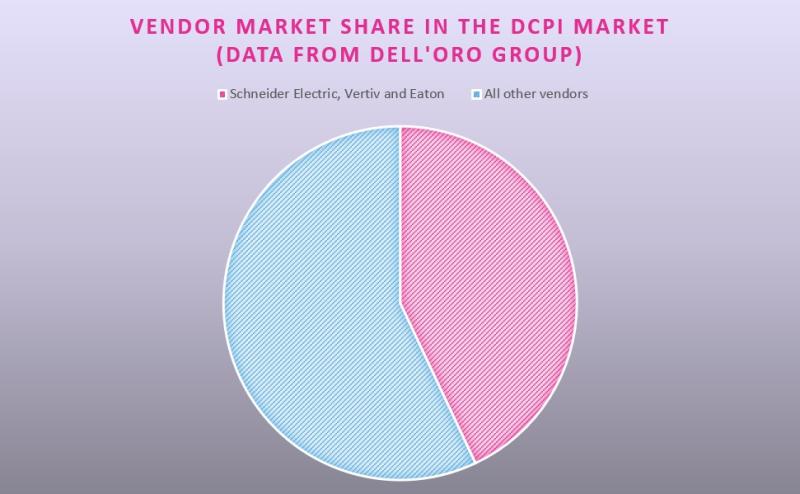

Schneider Electric is the top vendor in this space...for now

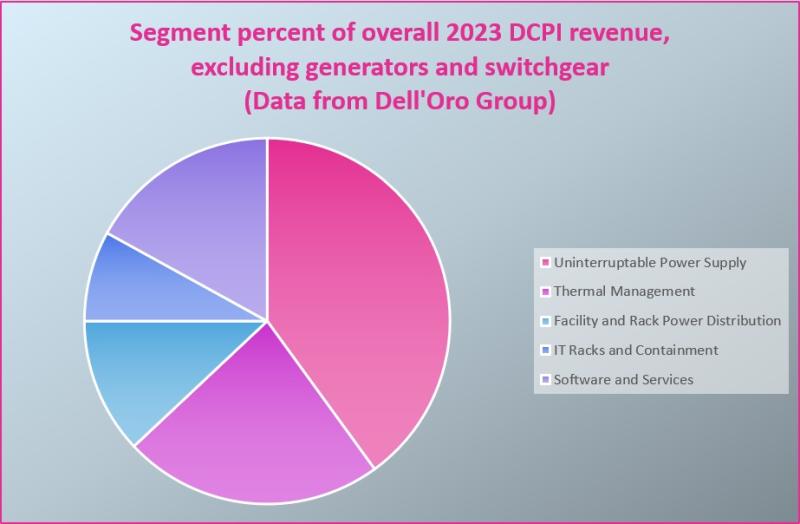

Power supplies are a huge chunk of the market but thermal management is expected to gain share

There is a LOT happening in the data center space right now as companies across the board race to build and expand to meet demand for more compute power. With fresh data from Dell’Oro Group in hand, we thought we’d zoom in and take a look at what’s happening in the data center physical infrastructure (DCPI) market with a few quick charts.

The DCPI market basically comprises the stuff that makes up the guts of data centers. That is, all of the uninterruptible power supplies (UPS), thermal management, cabinet power distribution and busway, rack power distribution, IT racks and containment, and software and services that go in them.

New data from Dell’Oro Group shows 2023 was a banner year for overall revenue growth in this market, which hit 16%. The growth rate is expected to slow significantly in 2024, but Dell’Oro Research Director Lucas Beran told Silverlinings that’s not because of reduced demand but instead because the market drivers are changing.

“Growth in 2021 through 2023 has primarily been the result of pandemic induced digitalization, which is now transitioning to physical infrastructure deployments to support accelerated computing for AI workloads,” he explained.

“Building these new facilities takes 18 to 24 months, which means they should start materializing in the second half of 2024. Oftentimes, I refer to the first half of 2024 as the ‘calm before the AI storm.’”

Right now, spending on UPS dominates the revenue landscape. Thermal management is a distant second, with facility and rack power distribution the fourth largest portion of the market. However, the sands are shifting, Beran said.

“As a result of the increased power distribution and thermal management requirements for accelerated computing workloads, those two market segments are expected to gain share over the short to medium-term,” he told us.

We’ll take the liberty here of noting that thermal management includes all forms of liquid cooling, which is on the rise as higher-power server chips proliferate to meet demand for AI computing. More on everything liquid cooling here.

In terms of top vendors, Beran said Schneider Electric is leading the pack, followed by Vertiv and Eaton. Together, these behemoths account for a bit less than half of the market. But here also, things are changing.

“Vertiv gained significant market share last year and is now within half a percentage point of Schneider Electric for the leading DCPI market position,” Beran said. “And, not to beat a dead horse, but Vertiv made some notable liquid cooling shipments in 4Q23 and announced that they are increasing their CDU manufacturing capacity by 45x in 2024.”

Beran previously told Silverlinings that liquid cooling revenue is expected to hit $3.5 billion by 2028. Vertiv is up against rivals including Submer, CoolIT and GRC.

You bet we’ll be watching closely as the market continues to evolve with AI demand!